More information about Council Tax

View details on late payment, debt enforcement, Council Tax appeals, stopping Council Tax support and other changes.

Why has another bill been sent to me?

Your bill could have changed for many reasons. If you are unsure please contact our call centre on 0343 178 2743.

If your circumstances change

It is important you advise us of any changes in circumstances affecting your Council Tax liability.

The following are examples of changes of circumstances affecting your liability:

- if you're moving in or out of your house

- if you believe you are entitled to a discount or exemption

- if you believe you are no longer entitled to a discount or exemption please contact us

- if the Valuation Officer (Inland Revenue) amends the band of your property - contact the Valuation Office Agency

- if your property changes from empty to occupied (or vice versa) please contact us

- if you believe that you may be entitled to a refund of Council Tax please contact us

We will re-calculate your liability and re-issue you with an amended bill. If the change of circumstance results in your Council Tax liability being overpaid, we will issue you with a credit bill and a refund request form.

If you vacate your property it is important that you provide us with a forwarding address, so we can forward your credit bill and refund request form to the correct address.

If your Council Tax support has changed

You will need to contact the Council Tax Support office directly on 0800 072 0042 to see why your entitlement has changed or stopped.

Landlord is paying the bill

Although your landlord is paying the Council Tax, if your tenancy is 6 months or more, you will remain on our records as the responsible person to pay. The onus will be on you to ensure your landlord pays in accordance with the instalment arrangement.

View your Council Tax account online

Register for an online account to view your payment history, make payments and more.

Make a payment now

Change your instalment dates

You can amend the payments by contacting the Council Tax offices. If you pay via direct debit you can only have payment dates on the 1st, 10th, 15th or 25th of the month.

Difficulty affording your Council Tax?

Recovery action can be stopped if a satisfactory payment arrangement can be agreed. To enable the City Council to consider what is a fair payment arrangement for you please complete and submit a Payment Arrangement Request form.

While you're doing this, please take time to check:

- Whether you should have claimed discounts and exemptions, in particular SPD entitlement.

- Whether you should claim Council Tax Support or other benefits due to low income now or in the past.

- Whether you should seek debt advice from a debt advice service, the Westminster CAB, Age UK or MoneyHelper or a solicitor, qualified accountant, authorised insolvency practitioner or a reputable financial adviser.

- Whether you have exceptional personal circumstances, such as a terminal illness, a physical or sensory or learning difficulty or other personal or financial difficulties that make payment of a debt very difficult or impossible, that you would like us to consider in relation to a hardship or S13A award to reduce your balance. If this is the case, please email [email protected]

Received an eBill

eBills are issued from [email protected]. You will need your post code to access the attached bill.

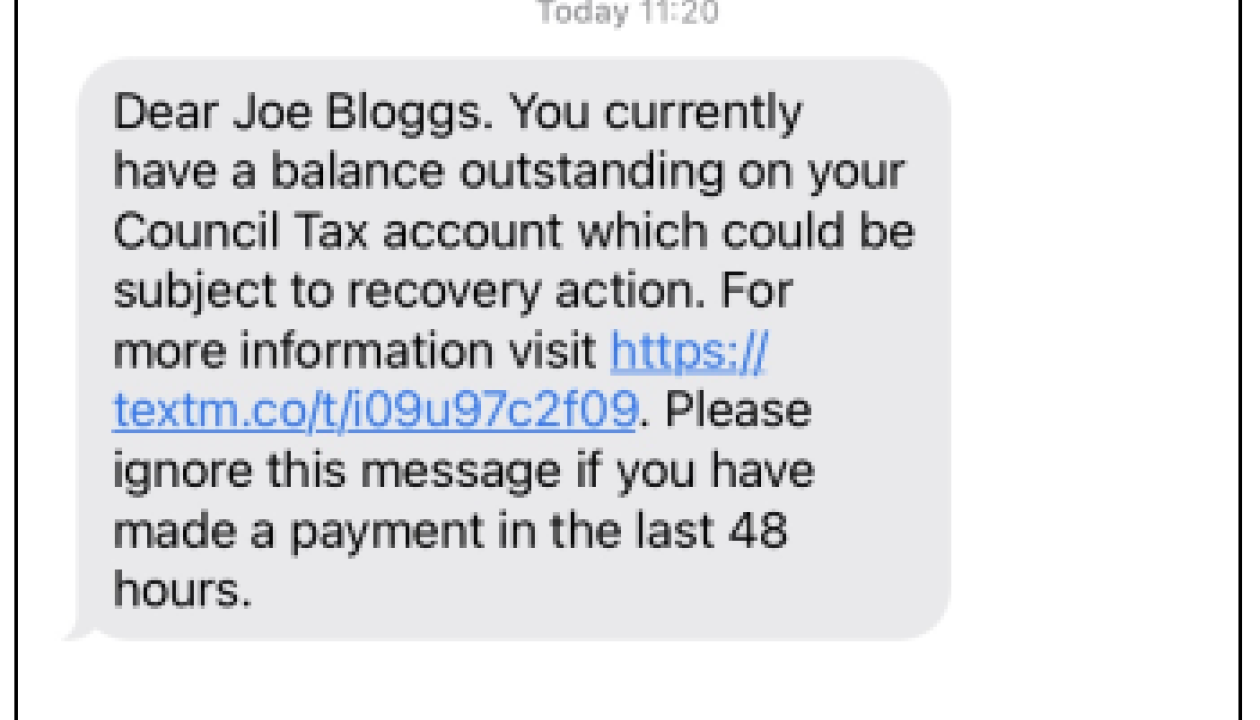

Received a text message

If you do not pay your instalments on time, we may contact you using a text message. The text message will provide a link that takes you to the verification screen.

An example of the text below:

You should click on the link provided. This will take you to a webpage where you will be asked to give your post code as a form of verification. The page will look like this:

Received an automated email

If you do not pay your instalments on time, we may contact you by email. The email will come from [email protected]

Received a reminder or final reminder

You will receive a reminder for the first late instalment. If you want to carry on paying by instalments, you must pay the amount shown on the reminder within 7 days. If you do not pay this amount within 7 days, you will lose your right to pay by instalments and they will be cancelled.

If your instalments are cancelled you will have to pay the full balance of your Council Tax within a further 7 days. If the balance is not paid in that time we will apply to the court for a summons to be issued against you for the unpaid amount plus costs.

We understand that you may not be able to make payment in full so we still allow a reasonable payment arrangement to be put in place. To make a payment arrangement on your arrears please contact our office immediately via:

- Payment Arrangement Request form

- Write to Westminster City Council, Council Tax, PO Box 165, Erith, DA8 9DW.

If you ask for a payment arrangement after you have been summonsed you will already have incurred court costs so do not delay in contacting us.

The Council may also send you messages by text, voicemail and/or email, to remind you that you have missed a Council Tax payment. We repeat these messages to make it easier for Council Tax payers to pay their instalments on time which should avoid costs being incurred.

Received a summons or liability order notice

You may be sent a summons because you have not paid the instalments on your council tax bill even though we have sent you a reminder. This means you have lost your right to pay by instalments and you must pay the full balance of council tax and the costs shown on the summons before the hearing date. If you do not pay the full amount including costs before the hearing date we will apply to the court for a liability order against you. If you do pay in full including costs we will not apply for a liability order.

The document below is enclosed with your summons and explains about the court process:

If a liability order is granted by the court further costs are added to your account and we will send you a Notice of Liability Order with a Request for information under Regulation 36 of the Council Tax (Administration and Enforcement) Regulations 1992. If you cannot pay in full you must return the Reg. 36 form within 14 days.

If you contact us to make an arrangement and keep to it then you can avoid further costs. However, once we instruct the enforcement agents, their fees cannot be waived.

The liability order allows us to instruct enforcement agents to collect the amount you owe. See Debt enforcement.

Alternatively, we can:

- order your employer to make deductions from your earnings to pay off your Council Tax debt in regular amounts or

- ask the Department for Work and Pensions to take money from your Universal Credit or Job Seekers Allowance to pay your Council Tax debt in regular amounts, or

- send a Statutory Demand and then lodge a Bankruptcy Petition at the High Court

- instigate proceedings in the County Court to place a charge on your property

Debt enforcement agents

The Council uses four Debt Enforcement companies. If you receive a letter or a visit you can find details of how to make a payment, details of fees and charges, debt advice and general information about enforcement agents by clicking on the relevant links below:

Council Tax recovery process

Advice agencies

Advice Agencies offer free, confidential and independent advice.

Age UK Westminster

Citizens Advice / Westminster CAB

- Citizens Advice website

- telephone 0300 330 1191

- CAB National Adviceline 0800 144 8848

MoneyHelper

You can get free debt advice from MoneyHelper.

If you are worried about debt, speaking to a trained and experienced debt adviser about your situation can help you see what the best decision for you might be. You can find advice on the MoneyHelper website.

Appeals

You may appeal if you think you are not liable to pay the Council Tax, for example, if you are not the resident or owner, or because your property is exempt. You may also appeal if you believe we made a mistake when we worked out the amount you should pay or the level of Council Tax support we have applied to your account.

If you want to appeal, you must first write to us at the address on the front of your bill. We will respond within 2 months. If you are not satisfied, you may appeal within 2 months of our decision. If we do not reply then after 4 months from you first writing to us you can appeal direct to the Valuation Tribunal.

If you appeal, you will still have to pay your Council Tax until a decision is made. If your appeal succeeds, we’ll refund any extra Council Tax you have paid.

For Council Tax appeals contact the Valuation Tribunal:

- address: 2nd floor, 120 Leman Street, London, E1 8EU

- telephone: 0300 123 2035

- [email protected]

- online: Valuation Tribunal Service website

For Council Tax support appeals contact the Valuation Tribunal Service:

- address: Hepworth House, 2 Trafford Court Doncaster DN1 1PN

- telephone: 0300 123 1033

- [email protected]

- online: Valuation Tribunal Service website

Read about Council Tax for properties in disrepair from the Valuation Office Agency.

Watch a video about comparable properties when appealing your Council Tax band.

Published: 31 March 2021

Last updated: 30 April 2024